Yesterday, the Eastsider reported on the proposed sale of a piece of land on Temple entitled for 69 units.

That got me thinking about the value of land in Echo Park and how it impacts the income taxes of property owners there. (Warning: This piece is a little heavy on the math, but it’s critically important. Not understanding this cost me thousands of dollars in income tax over-payment for roughly five years until I figured it out.)

Here goes:

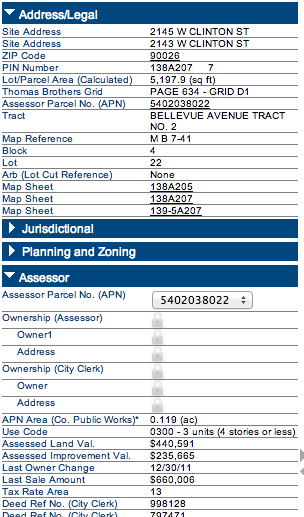

When you buy a piece of property, the county assessor assigns a portion of the purchase price to the value of the land and the rest to the value of the structure. Here’s an example, from ZIMAS:

This is the assessor information for 2143 Clinton St., a property in Echo Park we flipped through Better Dwellings back in 2011. Note towards the bottom where it says “Assessed Land Value” and “Assessed Improvement Value”. That’s the assessor making a wild-ass guess and attributing $440,591 to the land (65% of the total) and $235,665 to the structure (35% of the total).

Why does this matter? Unless you instruct them differently, most tax preparers will pick up the assessor’s breakdown for use in calculating depreciation. Remember: Depreciation is a non-cash charge against income (sort of an accounting fiction) that reduces your tax liability (so, you want depreciation to be as high as possible). Depreciation is ordinarily calculated as 1/27.5 of the value attributable to the structure at the time of purchase, charged against income for the first 27.5 years of ownership. So, if the value of the structure is higher, the depreciation will be higher, and your taxes will be lower.

For 2143 Clinton:

- Purchase price of $660,000

- Assuming a stable ratio of structure to total value: $235k / $675k = 35%

- Value of structure at purchase 35% x $660k = $231,000

- Annual depreciation, assuming assessor’s structure value is used = $231,000 / 27.5 = $8,400

That means the owner’s first $8,400 of cashflow from the property will be tax free. Not bad right? Wrong… the owner is probably getting a raw deal.

Consider that the seller of the land on Temple seller is trying to get $4.95MM for 69 units worth of entitled land. That’s equivalent to $4.95MM / 69 = $71,739 per unit of land. That’s pretty high and it’s much, much higher than the price of land at the time 2143 Clinton was purchased. I checked back on some comps for that period and I think the price of land in Echo Park in 2011 was somewhere between $40-60k.

2143 Clinton is on a 5197 sq ft lot (see above). The zoning is RD3, which calls for 3,000 sq ft of lot size for each dwelling unit. Can you see what I see? 2143 Clinton is sitting on land that only allows for building one unit on it (though it’s grandfathered as a triplex). If, at the time the buyer bought 2143 Clinton from me, the value of the land was $60k, that means the value of the structure was $660k (the purchase price) – $60k = $600k.

This means there ought to be $600,000 of value attributed to the structure. This makes sense; after all, most of the value in the property is in the fact that there are three income-producing units in Echo Park (plus the fact that we fixed them up and got high rents for them)!

Assuming $600,000 as the value attributable to the structure, the depreciation ought to be $600,000 / 27.5 = $21,818. That means the first $21,818 of cashflow ought to be tax free. The difference in the depreciation between this number and the original $8,400 is $13,418. Assuming a marginal tax rate of 50%, the difference in the depreciation should result in a tax savings of $13,418 x 50% = $6,709. Annually.

If you have additional tax savings of $6,709 per year for the first 27.5 years you own a property, that’s $184,497 in cash that you got to keep instead of paying out in taxes… which will make a huge difference to your net worth, particularly multiplied across an entire portfolio of properties.

The lesson, as always, is to query all of the assumptions made by your tax preparer. At the end of the day, you’re responsible for keeping money that is fairly yours, and knowledge of land prices and how they affect depreciation ought to be one tool in your tool box.

A few very important caveats:

- If you go around claiming to the IRS that land is 10% of total value, they’re probably going to audit you eventually… probably worth keeping it a bit more reasonable; and

- I’m not an accountant or a tax attorney, so don’t rely on this advice. Consult your own professionals!