On the numbers alone, buying income property south of the 101 beats buying in Silver Lake. There, we said it.

Before we get to the numbers, the area we’re talking about includes part of Westlake/Historic Filipino Town and the southern part of Echo Park. We’re going to call it…”South of the 101″.

Here’s a map:

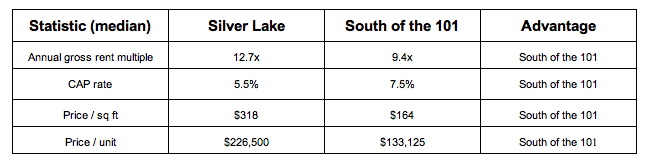

Here’s the “by the numbers” comparison:

Highlights of our analysis:

- Both the GRM and CAP rate tests get at the same idea, which is that you’re paying much less south of the 101 for each dollar of income

- On a bulk basis, where you ignore the rents and focus on the price per sq ft and the price per unit, south of the 101 also wins… you’re paying roughly half of what you’d pay in Silver Lake

- Finally, a note about rents, which aren’t captured in the above numbers: The rents are much lower south of the 101, in general. If you assume that there’s some kind of cap for what you can charge a normal, working tenant, it would appear that Silver Lake is a lot closer to that cap than South of the 101… so you might argue that there is more room for future rent increases to the south.

A possible explanation:

- Silver Lake is, generally, an amazing place to live, while the area South of the 101 remains pretty rough, albeit with some nicer pockets

- Most buyers these days are using FHA loans, which require that the buyer live on the property, at least for a while

- Anecdotally, many of the buyers I talk to are simply unwilling to live south of the 101, at almost any price

- So, non-resident buyers (investors) and those resident-buyers willing to tolerate a crappier neighborhood clean up to the south, because there’s so much less competition.

Interested in the Silver Lake numbers? Here they are.

Interest in exploring buying an income property, either north or south of the 101? Get in touch.

Fine print:

We looked at properties listed as sold by the MLS between 3/11/11 and 3/12/12 in the area defined in the map above. There were 18 properties in the initial sample. We removed four properties which, for various reasons, would not have qualified for a mortgage, meaning that only a professional flipper could buy them. For the remaining properties, we estimated the rents for units which were delivered vacant at time of sale. We also estimated the cap rates based on an expense margin of 30% of rents.

The Silver Lake sample used for comparison was for the six months to 2/28/12, while the South of the 101 sample was for the 12 months to 3/12/12.

Properties south of the 101 are generally older, so the maintenance costs may be higher, a fact which we’re ignoring.

My brother and I own a property on Reno St in the area in question. So maybe I’m biased.

Based on information from the Association of REALTORS®/Multiple Listing as of 2/28/12 and /or other sources. Display of MLS data is deemed reliable but is not guaranteed accurate by the MLS. The Broker/Agent providing the information contained herein may or may not have been the Listing and/or Selling Agent.

Here’s the raw data: Income Prop Survey – South of the 101 – March 2012