Buried in Paul Krugman’s column today was an interesting fact, of which I was not previously aware: As a result of action/inaction by President Obama, the income tax rate paid by the top 1% of earners is back up to where it was in 1979, before President Reagan took office.

Weirdly, upon reading the above, my mind jumped to a fundamental change which appears to have happened in the economy since the crash of 2008-9: Single-family home starts cratered and have so far failed to recover to “normal” levels.

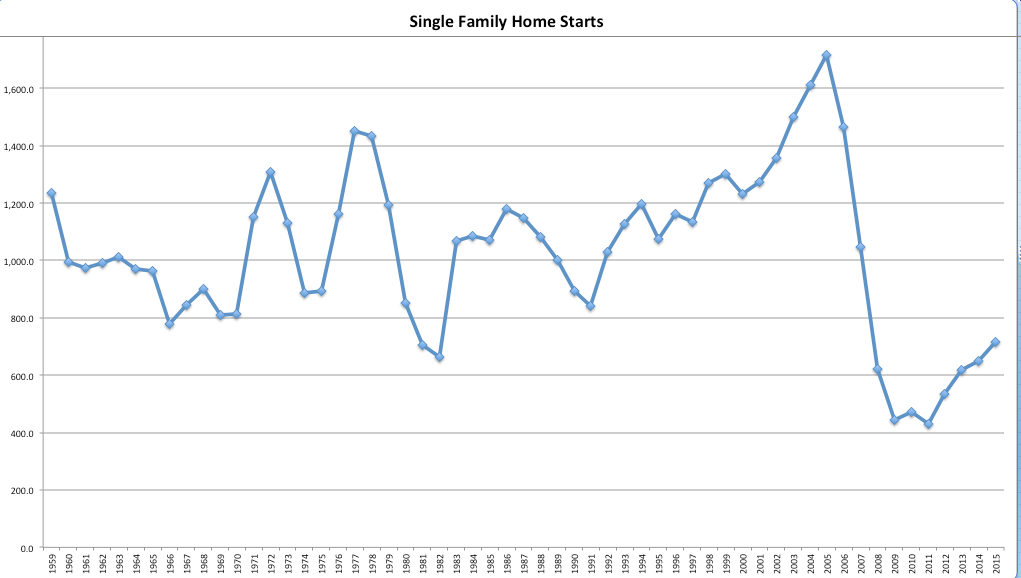

Here is a graph of single family home starts illustrating the above (forgive my excel skills, please!):

Note that starts remain very low by historical standards. And, because homebuilding represents something like 3-5% of GDP, this failure to return to “normal” levels causes real harm to the economy.

The question is: Why is this the case, particularly since Millennials have begun reaching the prime home-buying age?

There are lots of theories, including:

- Millennials want to live in cities and not suburbs, so they’re renting instead of moving out to the edges and buying;

- Developers got killed in the crash and many have not reentered the market;

- Construction financing

- Financing for buyers is tighter

But what if it’s a taxation issue?

Here’s a possible explanation:

- Income from the development and sale of single family homes is taxed as income, as opposed to capital gains

- Small developers are typically organized as LLCs, which are pass-through entities for the purposes of taxation, meaning that they pay personal income tax on their profits.

- Almost any successful development / sale of single family homes is going to push the developer into the highest tax bracket in the year the homes are sold

- The tax rate to which the developer is exposed, at least in CA, is north of 50% (including state taxes and the Obamacare surcharge)

Homebuilding is an extremely risky business (as demonstrated by the recent crash). It would not surprise me if a substantial portion of the smaller homebuilders who know how to do the business are looking at the balance of risk and (post-tax) reward and deciding to spend their time doing something else.