In case you’ve been under a rock: The stock market has been in free-fall since the beginning of October. Here’s a handy chart:

The thinking among investors is that the world economy is slowing due to weakness in Europe and China.

Usually, when investors get spooked by stocks, they sell stocks and buy relatively safer government bonds. And, indeed, you can see the result in US Treasury bond yields:

Yields were around 2.50% and then fell very rapidly down to 2.15% (as of noon today).

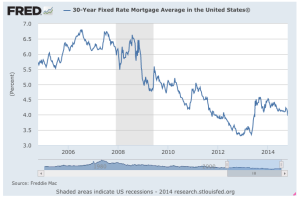

What does all of this mean for real estate? Well, mortgage rates tend to be pegged to the yield on t-bills. So, as investors get spooked and flee equities in favor of government debt, they are driving down the rate at which you can borrow on homes / apartment buildings / etc. Here’s the relevant graph:

It’s a bit hard to see, but rates, which were as high as 4.4% in January, are down to 4% as of today.

In real estate, all else being equal, prices rise and fall in an inverse relationship with interest rates (the cheaper the debt, the higher the price someone can pay for the asset and get an acceptable yield, and vice versa). So, if we’re entering another period of low interest rate loans, you can expect prices to stay the same or rise, all else being equal.